After the surge in the first quarter of 2024 (Q1), the cryptocurrency market faced a downturn during the second quarter (Q2). Despite this, Memecoins has remained the reigning champion of the market over the past three months.

Total cryptocurrency market cap down 14% in Q2

CoinGecko released its Q2 2024 crypto industry report on Tuesday. In the report, the cryptocurrency tracking site revealed that the total market cap declined in the last quarter.

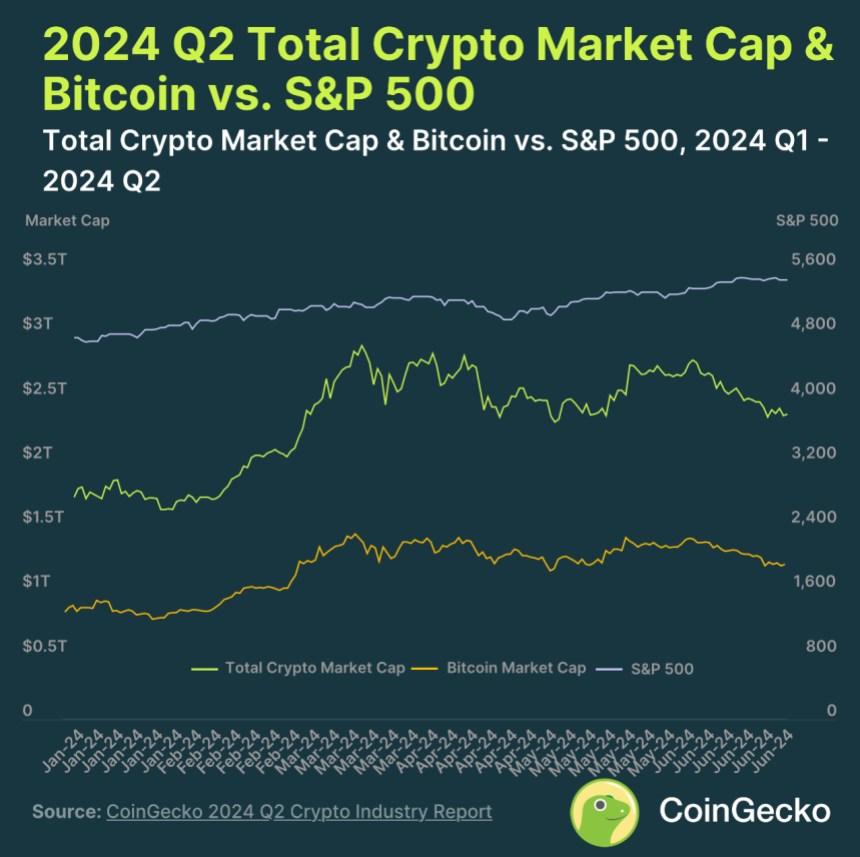

The total cryptocurrency market cap has fallen by 14.4%, or $408.8 billion, in the past three months. The cryptocurrency market closed the second quarter with a market cap of $2.43 trillion, failing to reach its all-time high.

By comparison, the total cryptocurrency market cap was $2.9 trillion in March. During the first quarter, the market rose 64.5%, doubling the growth in the third quarter of 2024.

In absolute terms, this quarter’s growth (+$1.1 trillion) was double the previous quarter’s growth (+$0.61 trillion). This was largely driven by the approval of spot Bitcoin ETFs in the US in early January, which pushed Bitcoin to an all-time high in March.

Additionally, CoinGecko highlighted that the cryptocurrency market cap outperformed the S&P 500, which saw a 3.9% increase. As a result, the correlation between the total cryptocurrency market cap and the S&P 500 decreased from 0.84 in Q1 to 0.16 in Q2.

In Q2, cryptocurrency volatility remained high, with the annual volatility rate for the total cryptocurrency market cap reaching 48.2%. Meanwhile, Bitcoin (BTC) and the S&P 500 saw volatility of 48.2% and 12.7%, respectively.

Memecoins Continue to Lead the Market

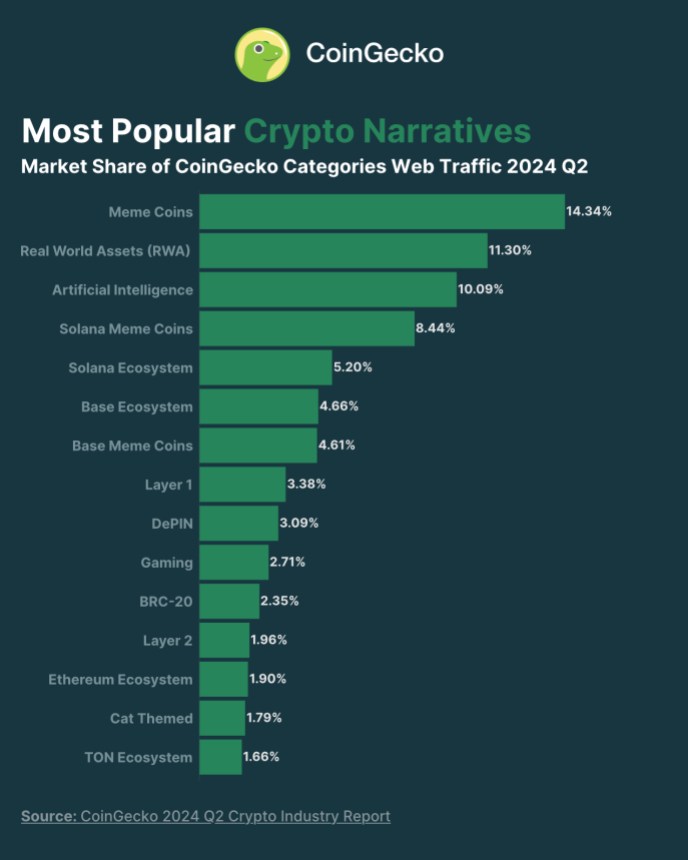

Despite the market downturn, Memecoins remained the most popular coin in Q2. According to CoinGecko’s category web tracker, the sector dominated the chart with a 14.3% market share.

In the last quarter, Memecoins emerged as the most popular and profitable coin. The sector generated massive returns in Q1 2024, with an average return of 1,313% across the top coins.

Tokens like Dogwifhat (WIF) and Book Of Meme (BOME) have become interesting market tokens, leading to the memecoin craze. These tokens have seen returns of over 2000% and 1000%.

This quarter, the market has seen a wave of celebrity purchases of memecoins. Public figures like Iggy Azalea, Caitlyn Jenner, and Andrew Tate have joined the industry amidst controversial launches, hacks, and fraud allegations.

Moreover, PolitiFi memecoins have been gaining popularity. Last week, these tokens outperformed most categories in the cryptocurrency market after the failed assassination attempt on Donald Trump.

Four of the top 15 most popular memecoins were memecoin-related, with Solana and Base memecoins recording 8.44% and 4.61% respectively. Meanwhile, cat-themed tokens beat out the sector’s Q1 champions, dog-inspired tokens.

This quarter, cat-inspired tokens made it into the top 15. The category has performed remarkably this cycle, with tokens like Cat in a Dogs World (MEW) and Popcat (POPCAT) rising over 200%.

Similar to Q1, real assets and AI tokens were second and third in popularity. Real assets recorded a market share of 11.3%, while AI tokens captured 10.9% of market interest.

Featured image from Unsplash.com, chart from TradingView.com