The week was marked by a significant decline in the cryptocurrency market. The values of leading assets such as Bitcoin (BTC) and Ethereum (ETH) fell by 12% and 17% in the past seven days, respectively.

Despite its statistically positive correlation with Bitcoin, this decline has also affected the values of many meme assets. All ten meme assets by market cap have seen significant price declines of double digit percentages over the past seven days.

Dogecoin (DOGE) Drops Below Major Moving Average

At the time of writing, Dogecoin (DOGE), the leading cryptocurrency, is trading at $0.095. The coin has dropped 24% in value in the past week. At its current price, Dogecoin is trading at a price level not seen since February.

The coin’s price fell below its 20-day exponential moving average (EMA) on June 7 and has been trading below that level ever since. The 20-day EMA of an asset measures its average price over the past 20 trading days.

When the price falls below this level, it indicates a shift in momentum, where sellers are overpowering buyers. It indicates a sharp increase in selling pressure and suggests that the price decline will continue.

Read more: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

If the DOGE price continues to decline, it will drop to $0.091.

Shiba Inu (SHIB) Fights Off Declining Buying Pressure

Shiba Inu (SHIB) price has dropped by 23% in the past seven days. At the time of writing, the meme coin is trading at $0.000013.

The demand for SHIB among market participants has also been affected by the overall bearish trend in the market. This is based on the coin’s declining Accumulation/Distribution (A/D) line readings.

This indicator assesses the buying and selling pressures (accumulation and distribution) behind an asset’s price movement. When it is declining, it indicates that selling pressures are increasing compared to buying pressures.

At the time of writing, SHIB’s A/D line is worth $815.99 billion. This week alone, the value has dropped by 86% from the $6 trillion it recorded on July 1.

If the price of the asset also falls along with the decreasing A/D line, as is the case with SHIB, this reinforces the bearish signal and indicates that the downtrend may have more momentum.

If this trend continues, SHIB could drop to $0.000012.

Read more: How to Buy Shiba Inu (SHIB) and Everything You Need to Know

If this prediction is invalidated by a sharp increase in buying activity, the price of the meme coin could rise to $0.000016.

Pepe (PEPE) Stock Drop Puts Long Traders in Trouble

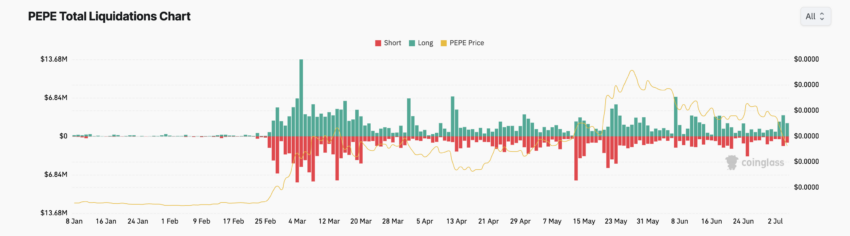

Solana-based frog-themed coin Pepe (PEPE) has dropped 36% in value over the week under review, prompting a liquidation of many long positions in the cryptocurrency derivatives market.

Liquidation occurs in the derivatives market for assets when a trader’s position is forcibly closed due to insufficient funds to maintain it.

Long liquidation occurs when the value of an asset suddenly declines, and traders with open positions in favor of rising prices are forced to exit their positions.

The significant bearish bias that continues to track the altcoin suggests that more long liquidations are likely. According to PEPE’s Parabolic Stop and Reverse (SAR) indicator readings, its points are above the meme coin’s price at press time.

This indicator measures asset price trends and identifies potential price reversal points. When its points are placed above an asset’s price, the market is said to be in a bearish trend. This indicates that the asset’s price has been declining and may continue to decline.

If this decline continues, PEPE could drop to $0.0000077.

However, if the demand for PEPE increases, the token price may rise to $0.0000090.

Disclaimer

In accordance with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms & Conditions, Privacy Policy and Disclaimer have been updated.