The latest drama to give Kyle Chu and Kyle Davis

Ox.fun, a Memecoin exchange that came out of the exchanger Open (OPNX) residue, found himself at the insolvency rumors center this week after freezing a million dollars of user deposits.

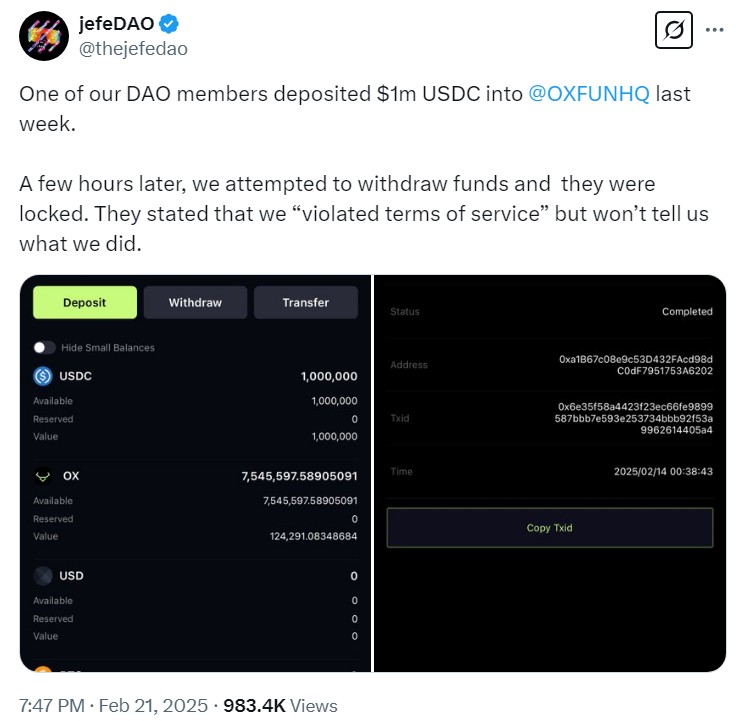

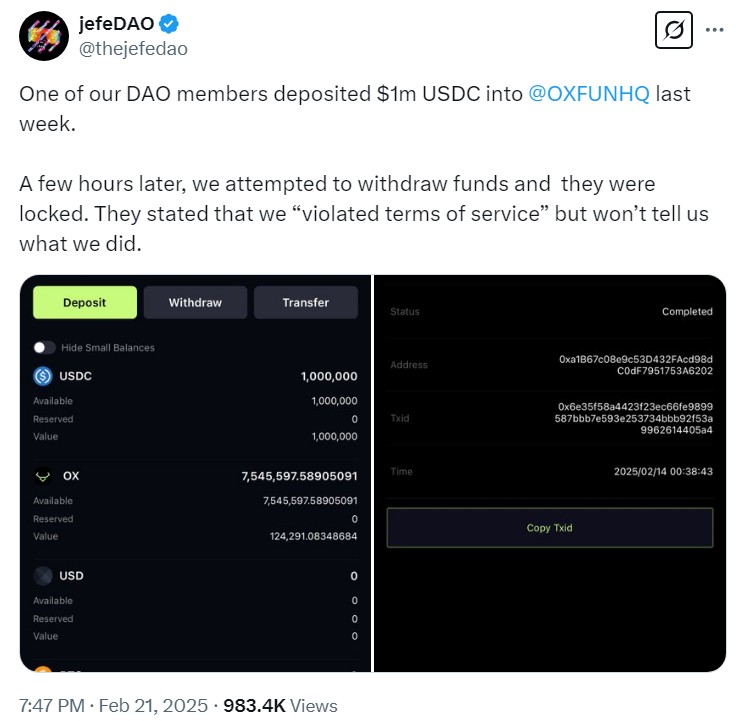

The controversy erupted on February 21, when the X Jefao user claimed X that one of its members had deposited a million dollars in USDC in Ox.fun, only to find closed money at a later time. According to JeFidao, the system used to accuse the user of violating the service conditions.

Nicholas Bale, founder of Ox.fun, returned against allegations, saying that the user has Try to exploit Platform. Ox.fun Claim The individual participates in the “market manipulation” to earn $ 120,000 of the distinctive ox symbols, which prompted freezing. Exchange Add An agreement has been reached with Jefedao, the account has been returned, and the original deposit will be returned.

The accident caused OX.Fun’s financial health audit, where Coinbase’s CEO of Coinbase indicated that most of the stock exchange’s holdings seemed to her symbols, a potential red mark of liquidity fears. The position exacerbated when the distinctive ox symbols lost a great value in the controversy, which strengthens speculation about the platform’s sheet.

Ox.fun refused concerns, male The portfolio of the full range of platform reserves has not reflected. A member of the Ox.fun team told the magazine in a telegram that all the user funds are supported 1: 1 and said that the stock exchange will launch the transparency information plate “in the coming days”.

In addition to scrutiny is Ox.fun relationships with Kyle Davies and Su Zhu, the founders of the hedge fund in Singapore, Three Arrows Capital. The company, which was one of the largest in the encryption area, is exhausted in 2022 after it made aggressive bets intended to benefit from it during the market decline, which leaves creditors billions of dollars. After its collapse, Davies and ZHU Open Exchand (OPNX), a bankruptcy trading platform, which was later closed and replaced by Ox.fun, where Davies and ZHU officially works as consultants.

Bybit declares war against North Korean infiltrators

Bybit suffered from the largest exploitation in history on February 21 by losing more than $ 1.4 billion, which was determined as North Korean infiltrators.

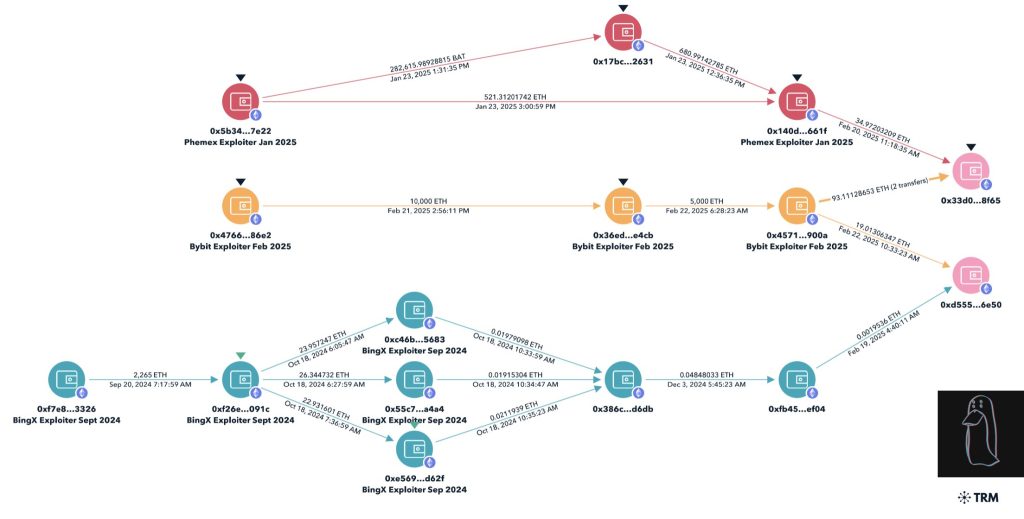

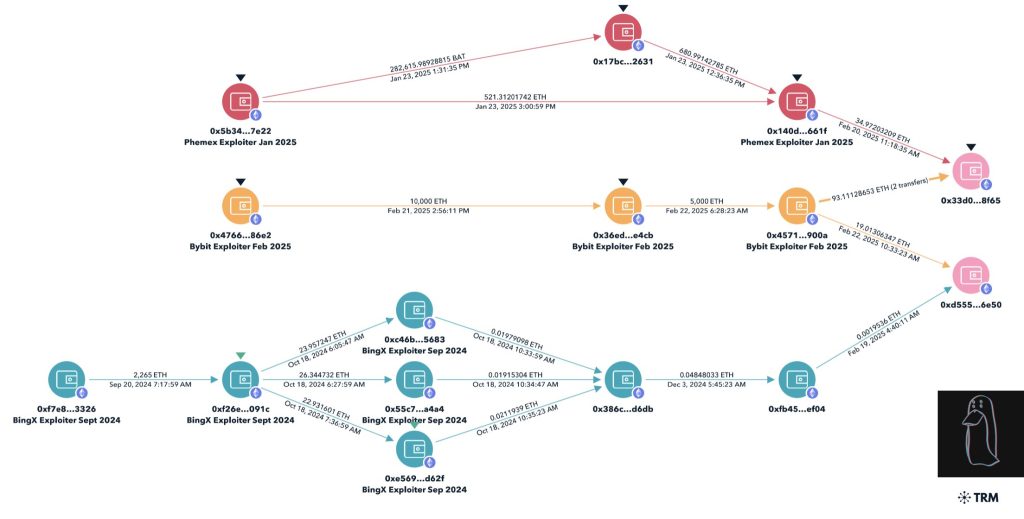

The Crypto Zachxbt investigator was the first to officially recognize the infiltrators and a public brand, claiming that the reward that Arkham set up to provide conclusive evidence for their identity. He did this by linking a common title used in the exploitation of Bybit with previous inventions against Asia -based Asia and Pingx and PHEX, and both are also attributed to the Lazarus group. The FBI later confirmed that the attack was conducted by Lazaros.

Bybit 401,000 excreted exploitation, and the infiltrators quickly distributed money across multiple portfolios, ultimately led to more than 11,000 specific portfolios, according to researchers in Al -Alailili.

A feature of North Korean infiltrators, regardless of the division of money into different portfolios, converts them into original origins such as ether before replacing it to Bitcoin. The thorchain chain platform, which allows direct asset bodies such as the ether to Bitcoin, has witnessed a huge increase in swap size, exceeding one billion dollars in less than 48 hours from February 26.

After losing its money against North Korea, Bybit announced a war against electronic unity in the Kingdom, and received support at the level of industry from partners and competitors in tracking funds and freezing.

However, EXCH, an unknown exchange exchange of a return to freezing illegal funds associated with the exploitation of Bybit. An exchange denies money laundering to North Korea.

Read also

Features

Ethical responsibility: Can Blockchain really improve confidence in artificial intelligence?

Features

What actually seems to use bitcoin in El Salvador

The largest South Korea Stock Exchange is prohibited from accepting new users

The Southern Korean Organizers dealt with a crushing blow to the largest exchange of cryptocurrencies in the country, compassion, imposing a three -month work suspension and executive chapter.

On February 25, Financial Intelligence Unit (FIU) Declare Disciplinary measures against UPbit and its executives to violate them Work to report and use the specific financial treatment information.

Penalties are effectively freezing Upbit’s ability to treat cryptocurrencies and withdraws for new customers for a period of three months. Nine CEOs, including CEO Lee Seok-Loo, who received an official warning, and the company’s compliance official, who was directly launched-the first time that the organizers were prolonged by an officer of compliance in the South Korean encryption exchange.

Upbit authorities have accused the repeated warnings to engage in about 45,000 transactions with unregistered external exchanges. The organizers also found failures in checking clients, allowing not verified trading despite the strict financial compliance requirements.

Despite the supervision of these violations, CEO Lee Seok-Woo received only a slap on the wrist, as the organizers pointed to his role as a supervisor instead of a direct participant in misconduct.

While the sanctions are among the most severe imposed against the South Korean Corphine company, Opebit has reduced their importance, and they insisted that trading services, deposits of deposits, and encryption exchanges will remain uncommon.

Talk to local correspondents, Upbit He said The stock exchange weighs all options, including legal methods, to challenge sanctions.

Read also

Features

Make sure ETHEREMM – Steve Newcomb reveals the main ZKSYNC guidance

Features

Tornado Cash 2.0: The race to build safe and legal currency mixers

Vietnam refuses to propose a sand box for encryption payments

The Ministry of Finance in Vietnam (MOF) rejected a proposal to provide encryption transactions in the upcoming financial centers in the country, noting concerns about financial security and organizational gaps, government media Hanoi Times I mentioned.

The decision is a setback for his efforts to put the city of Hoshi Minh and Danish as Venins Centers, where the government remains cautious about the risks associated with cryptocurrencies and digital assets, which are still not undergoing organization in Vietnam.

The Ministry of Planning and Investment in Vietnam (MPI) has proposed the launch of a regulatory sand fund that allows digital transactions in new financial centers in the country, scheduled to start on July 1, 2026.

However, MOF opposed the schedule, saying that without a legal framework governs digital assets, these transactions are great risks. According to the officials, the officials emphasized that the laws covering the issuance, trade, and licensing services and cybersecurity must be valid before allowing digital assets in the financial system in Vietnam.

The Ministry urged the other ministry, including the government bank, to influence this, as the potential use of digital currencies of payments, which fall under the jurisdiction of the central bank.

MOF also recommended that the government take direct control of any experimental program and remove the date of the start of July 1, 2026 of the proposal.

Subscribe

The most attractive readings in Blockchain. It was delivered once a week.

Johan Yun

Yohan Yun is a multimedia journalist covering Blockchain since 2017. He has contributed to Crypto Media Outlet Forkast as an editor, and has covered Asian technology stories as an assistant correspondent for Bloomberg Bna and Forbes. He spends his spare time cooking, trying new recipes.

Read also

Hodler Digest

The new SBF accusations, the history of the Shafa and Roumiya thorn as financial advice: Hodler Digest, 19-25 February

5 minutes

February 25, 2023

An American judge says that SBF is accused of new criminal charges, and the upgrade ethereum shapella on the road, and emojis can consider financial advice.

Read more

Hodler Digest

Binance News, Circle plans for public relations, and upscale comments: Hodler’s Digest, 4-10 July

9 minutes

July 10, 2021

The best (worse) quotes, adopting and highlighting regulations, leading coin, predictions and much more – one week on Cointelegraph in one link!

Read more