Since the Dencun promotion, which dramatically reduced the fees on the ETHEREUM 2S layer, the non -central embroidery base in Coinbase has increased in the numbers of users, transactions and closed total value.

As with Solana Fast and Cheap Flockchain Solana, most of the activity is fed with a deteriorating gambling on Memecoins, where hope is competing to reap amounts of money from small expenses.

But the investigation conducted by a magazine found that the vast majority of Memecoins on the platform has security weaknesses that can expose users to great losses.

And one of each sixth maliciously and uses a variety of tricks to steal the user’s money.

Security profiles magazine collected from 1000 new base symbols – almost all of the Memixin or fraud – launched between 19 and 25 March. This is not a comprehensive review, as there are more than 380,000 Erc-20 symbols On the base currently; However, it is a representative sample of 1000 symbols launched this week.

The symbols were analyzed by automated auditors on the Dextools trading platform to determine whether each project has implemented three basic security measures: closed liquidity, verified contracts and honey’s absence.

For beginners, this means:

Closed liquidity In decentralized financing (Defi) is when a portion of the trading pair is sealed in the encrypted currency under a smart contract. This directly addresses withdrawal fears.

A verified contract It means that the project’s smart contract is accessible to investors to review potential risks.

Hibsut It is a type of fraud that urges investors to highly profit capabilities but prevents them from selling.

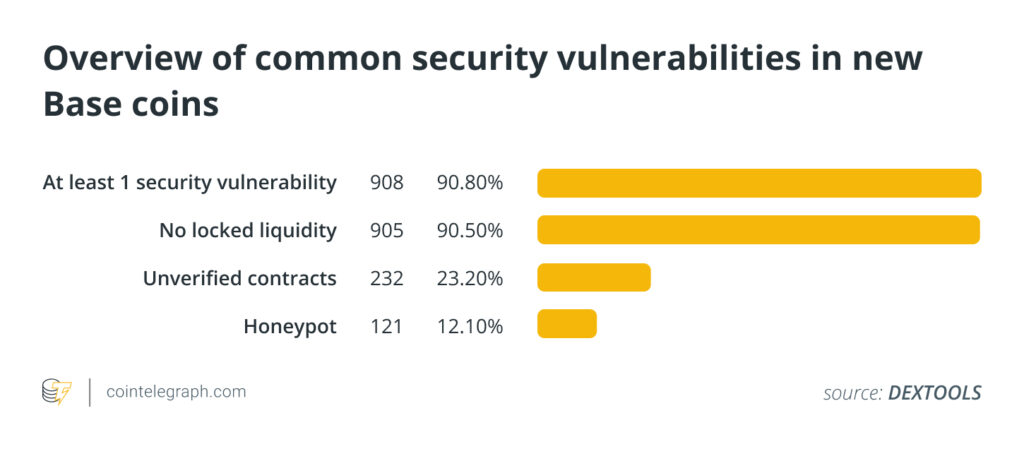

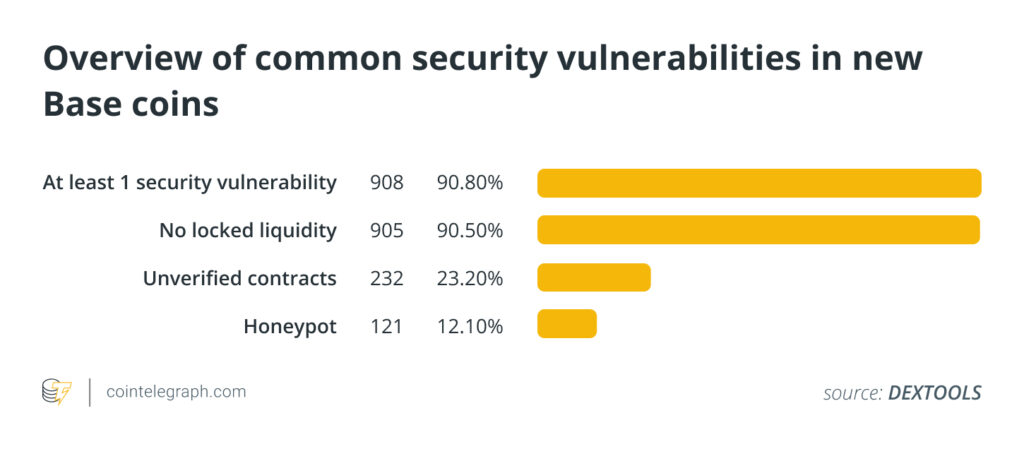

According to the analysis, 908 projects, or 90.8 % of the samples were taken from, failed, at least from these security conditions.

Although some security defects may indicate illegal activities, they are likely to reflect the lack of knowledge of Memecoin’s creators about appropriate security measures, especially if she launches a symbol such as a joke or hunting in the industry.

“This scenario emphasizes the challenges facing projects that may not enjoy the resources necessary to employ security experts or make independent assessments of their smart contracts,” said David Shid, the chief operational employee at the Halborn Security Company, for the magazine. He adds that the fact that many projects are just copies and paste the existing symbols means that the defects are repeated.

“The tendency of these projects to be thorns for current projects or created through artificial intelligence means that they often inherit weaknesses or present new projects.”

17 % of the symbols on the base are explicit codes

But while the non -caffeine founders who swing through launch explain most of the issues, a high percentage of annoying symbols are explicit fraud.

According to the analysis, 16.9 % of projects are suspected of a malicious intention through exaggerated “taxes”, or they are, a type of fraud that includes conditions to prevent owners from selling symbols.

A potential instructor was found in 121 projects. An additional 48 has a sales tax of up to 100 %, which is not different from explicit theft.

It should be noted that Memecoin’s fraud can take different forms, and automated accounts can designate some symbols or even miss some creative plans.

Pre -dirt withdrawals have become an escalating trend on the Solana network, and it is difficult to determine it because it often depends on social engineering and noise tactics. Sometimes, a symbolic prior is made for a project that does not even contain a smart contract.

A recent study by Blockaid It is said I found that half of the Solana pre -icons launched between November and February were harmful.

Read also

Features

How the workforce changed the encryption in the epidemic

Features

The encrypted winter can affect the mental health of Hodles

The most common mechanical exposure to the base is the potential Pulling

The most common security weakness was found among 1,000 projects analyzed in their liquidity gatherings.

“The closed liquidity immediately prevents the withdrawal of the LP carpet and provides a level of confidence that I see as the basis for any project with the desire to show themselves worthy of trust and legitimacy.” Mystcl On the base, tel magazine.

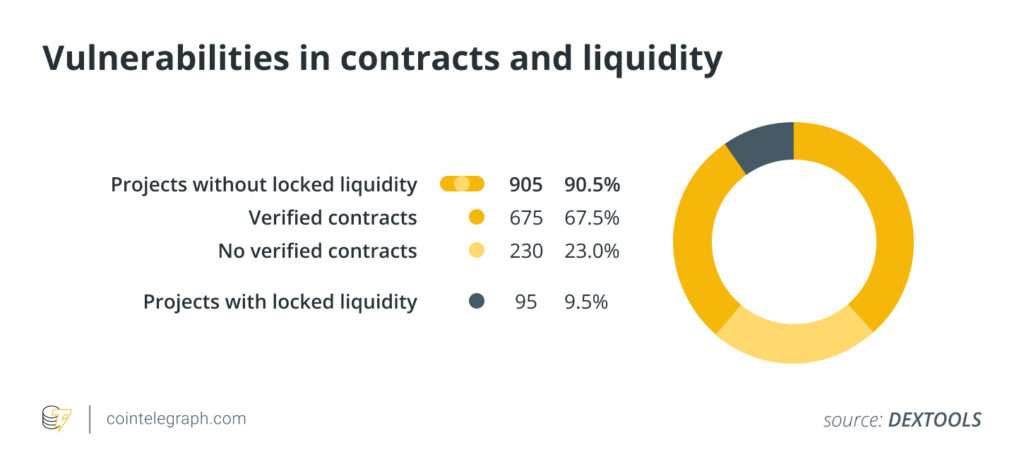

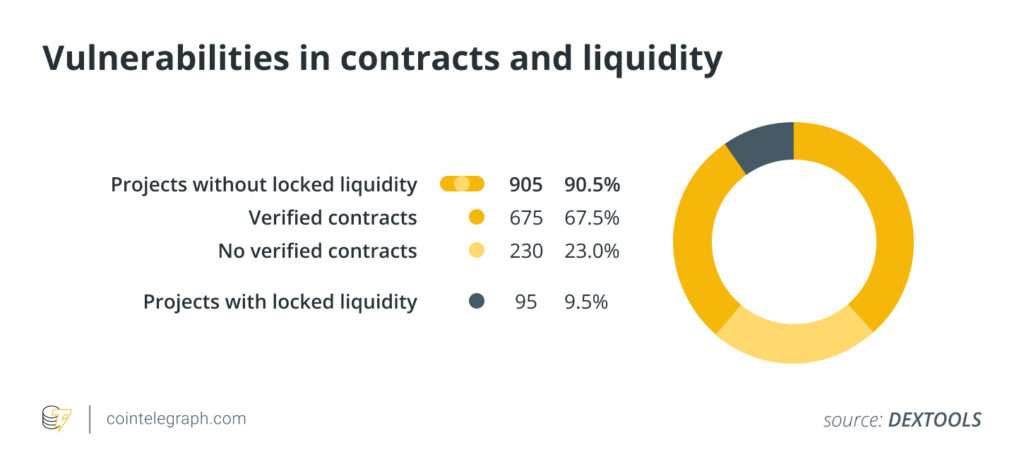

Among the distinctive symbols from which samples were taken, 905 projects, or 90.5 %, are not closed, liquid, making them vulnerable to pulling the rug.

In decentralized exchanges, a symbol must be paired with a more firm origin like ether or stablecoins. Investors contribute to increasing the value of the liquidity group by exchanging these applicable symbols for the new mechanics.

Pastir pulling is a type of fraud where developers withdraw all ETH, stablecoins or other assets from liquidity and abandonment of the project.

Direct anti -procedures against the risk of carpet pulling are when developers close their liquidity baths. This procedure is a guarantee supported by the code that they will not be able to reach the liquidity gathering, and they cannot reach it. Sometimes, these promises have expiration dates.

Just because the project does not contain closed liquidity that it does not automatically classify as a carpet awaiting disposal.

According to Vesper, there may be reasonable explanations of the liquidity that is opened, such as the deportation of liquidity from a central exchange (DeX) to another.

In such cases, projects can have additional security layers to obtain confidence, such as the presence of verified contracts.

Of the 905 projects without closed liquidity, 675 of them verified the contracts.

As for 230 other symbols without closed liquidity or verified contracts, Vesper, which is also the main developer of the projects he founded, says that “there is no legitimate reason, the distinctive symbol will have an unintended contract.”

“DAPPS may protect its symbol for competitive reasons (with checking a necessary thing in this case) [but] “The symbols have no good reason for not verifying their contract,” says Vesp.

Coinbase provides a somewhat response to the magazine’s questions, noting that the base is inexpensive.

“Although we do not support specific assets, we support builders who enter the basic ecosystem, and we continue to focus on making technology on the series easier with faster and cheapest transactions.”

Memecoins Pump Base Defi to new levels

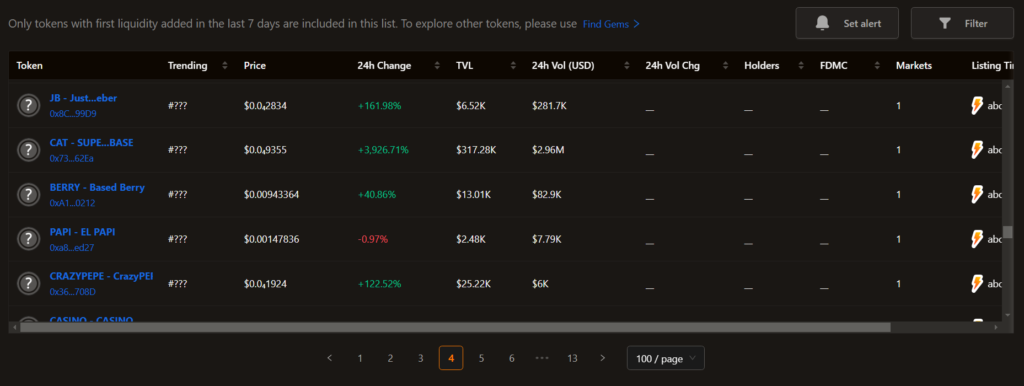

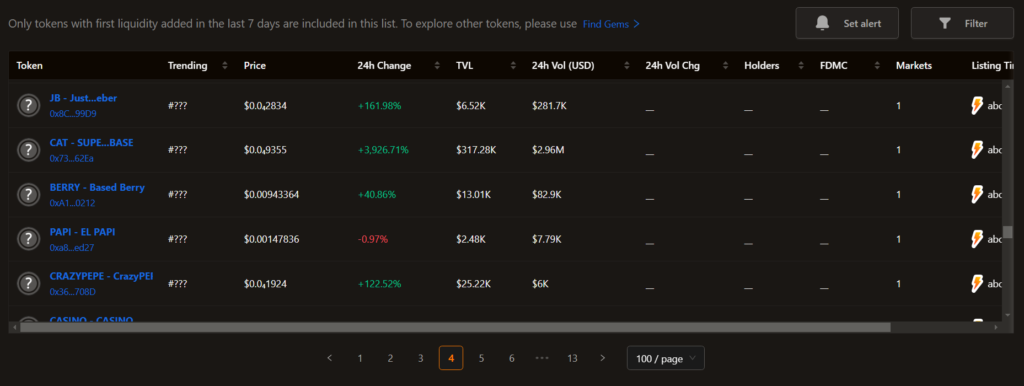

When the magazine collected security profiles in 1000 basic projects, there were about 1,300 new code in a period of seven days until March 25, according to the Birdeye commercial provider.

But in April 2, this number exploded to 4000.

Throughout this period, the new symbols launched on Solana maintained fixed weekly weekly estimates.

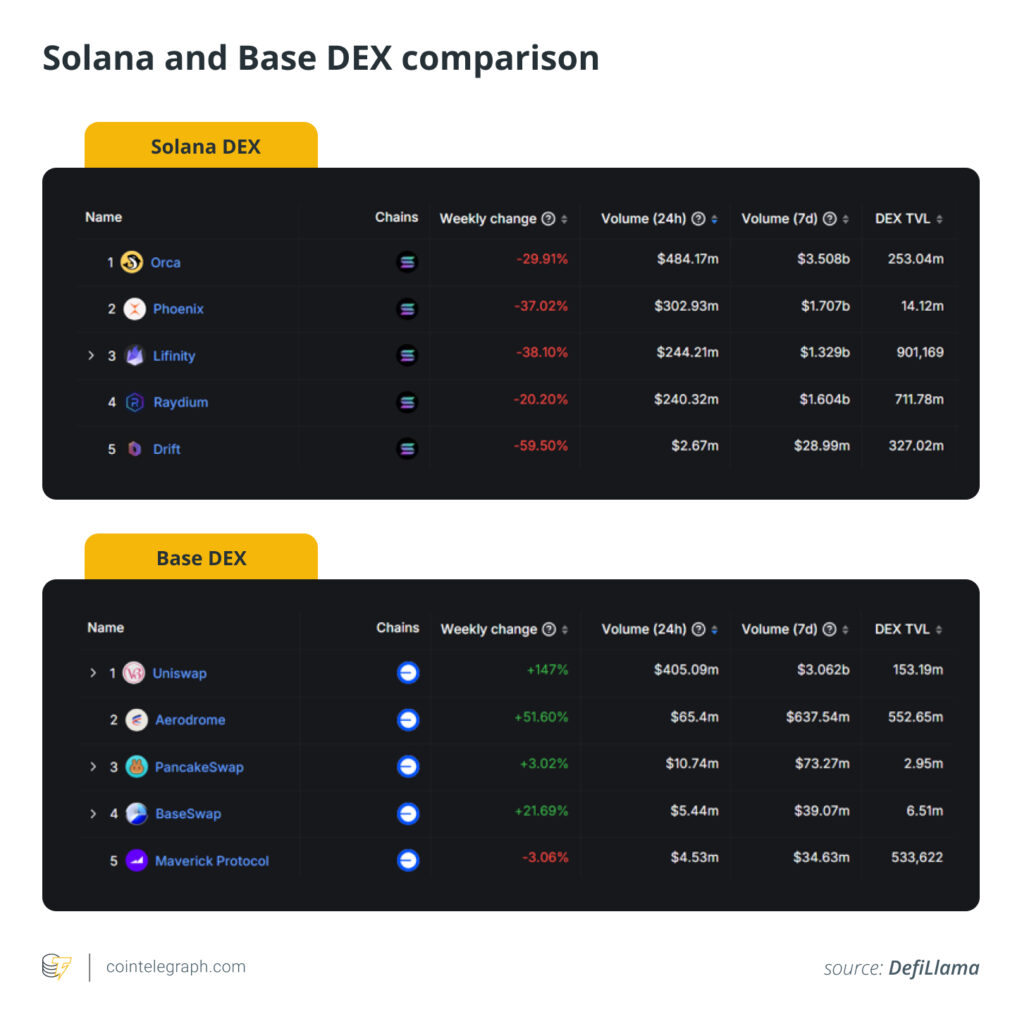

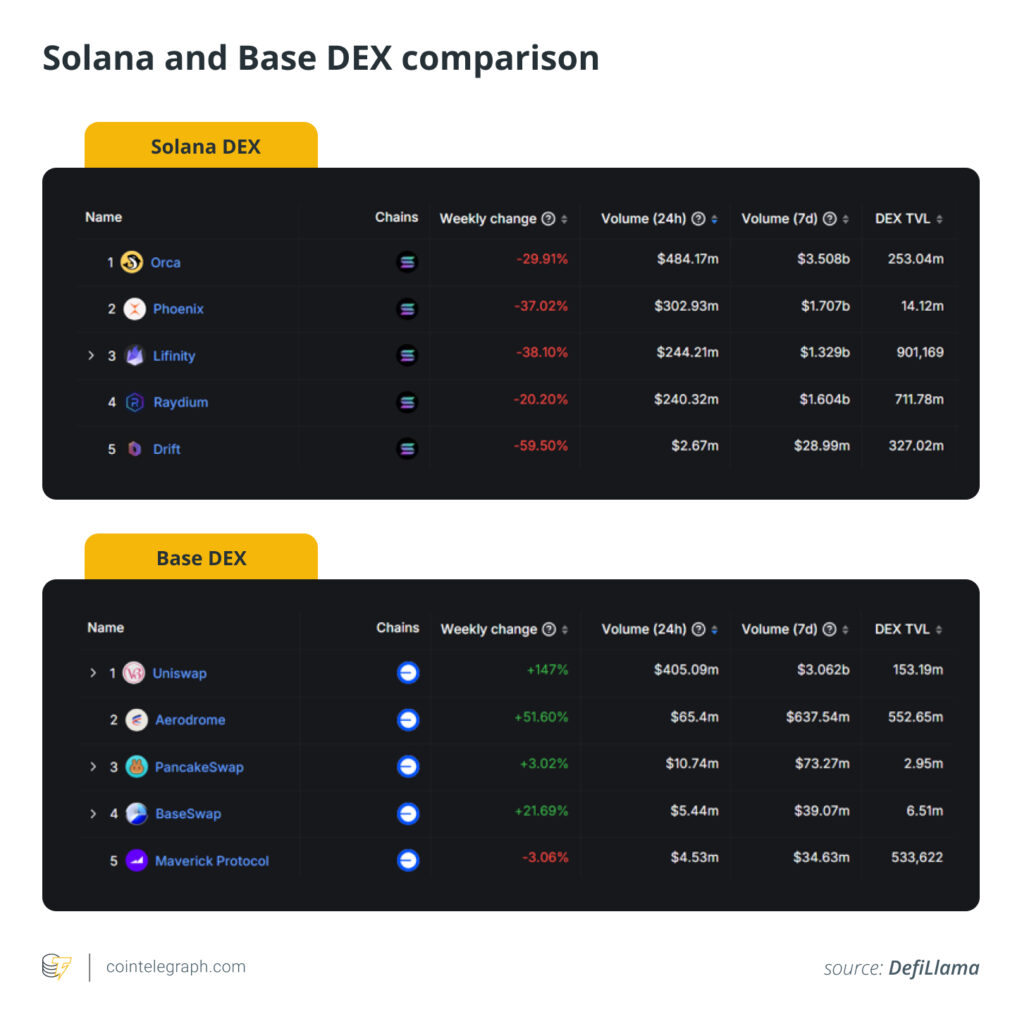

Although the Base’s height to Memeco Stardom did not have a significant impact on the rate of new projects on Solana, the DEXs folders tell a different story.

In the seven days until April 2, trading sizes in Solana Dexs decreased, as the first five centers decreased by 20 % to 59.5 %, according to Devilia.

Meanwhile, four of the five best foundations were DEXs, positive changes in trading volume, as the UISWAP led the fees an increase of 147 % to 405.09 million dollars.

In Solana, the trading volume in UISWAP will occupy the second rank, behind Orca with a value of $ 484.17 million.

Incalcred

The last Memecoin pump divided the industry into two conflicting camps.

Be one side Highly important From the popularity of Memecoins because of its lack of benefit and high fraud rates.

“The security weaknesses in the new MIMEN projects reflect … a broader trend that can be generally observed through the mechanical ecosystem,” says Shid.

On the other side of the spectrum, some industrial monitors chant the Memecoin gathering in order to introduce new investors into the area.

Read also

Features

Return 2025: Are you ready for ethereum to catch up with Bitcoin and Solana?

Features

Checks in the Philippines: necessity is the mother of adoption

“You can highlight these things as stupid and worthless, but if they draw attention and more engineers to the space, it is a positive value for the series itself,” said Arthur Hayes, the co -founder of the bimics derivatives.

Vespar says that his roots were adjacent to “creating benefit”, but recently, he had a change in the heart.

“I realized that there are unsuccessful energies that push the encryption space as well, and that they are as part of it as part of it like Blockchains and smart contracts.”

Subscribe

The most attractive readings in Blockchain. It was delivered once a week.

Johan Yun

Yohan Yun is a multimedia journalist covering Blockchain since 2017. He has contributed to Crypto Media Outlet Forkast as an editor, and has covered Asian technology stories as an assistant correspondent for Bloomberg Bna and Forbes. He spends his spare time cooking, trying new recipes.